Widebody cargo aircraft are getting a long overdue refresh. During the course of the next years Airbus and Boeing will launch their all-new freighter models A350F and B777-8F. Purpose-built and designed to replace the aging B747-Fs, B777-Fs, A330Fs and the lately growing fleet of Passenger-to-Freighter conversions. Let’s have a look at what is new, why it matters and how the new models differ.

Freighter Models in a Nutshell

The freighter market knows numerous models and variations: Freighters designed and built from scratch, as well as conversions from (older) passenger models into freighters. The list is long. Let’s focus on today’s two most common models.

The oldest freighter found in today’s fleets is most likely the B747-F in its various versions. The “queen of skies”, like it is often titled, is a real beauty design-wise and offers unmatched attributes until today. It is still leading the board in terms of payload (approx. 112 tons) and loading capabilities. The iconic nose-loading for oversize cargo is its most unique value proposal.

But the old jumbo has outdated operational efficiency for standard cargo. The last B747F-8F had been produced in 2023. Even Cargolux with a fleet of 30 B747s (arguably the largest fleet of jumbo freighters) considers renewing their fleet by ordering the new B777-8F.

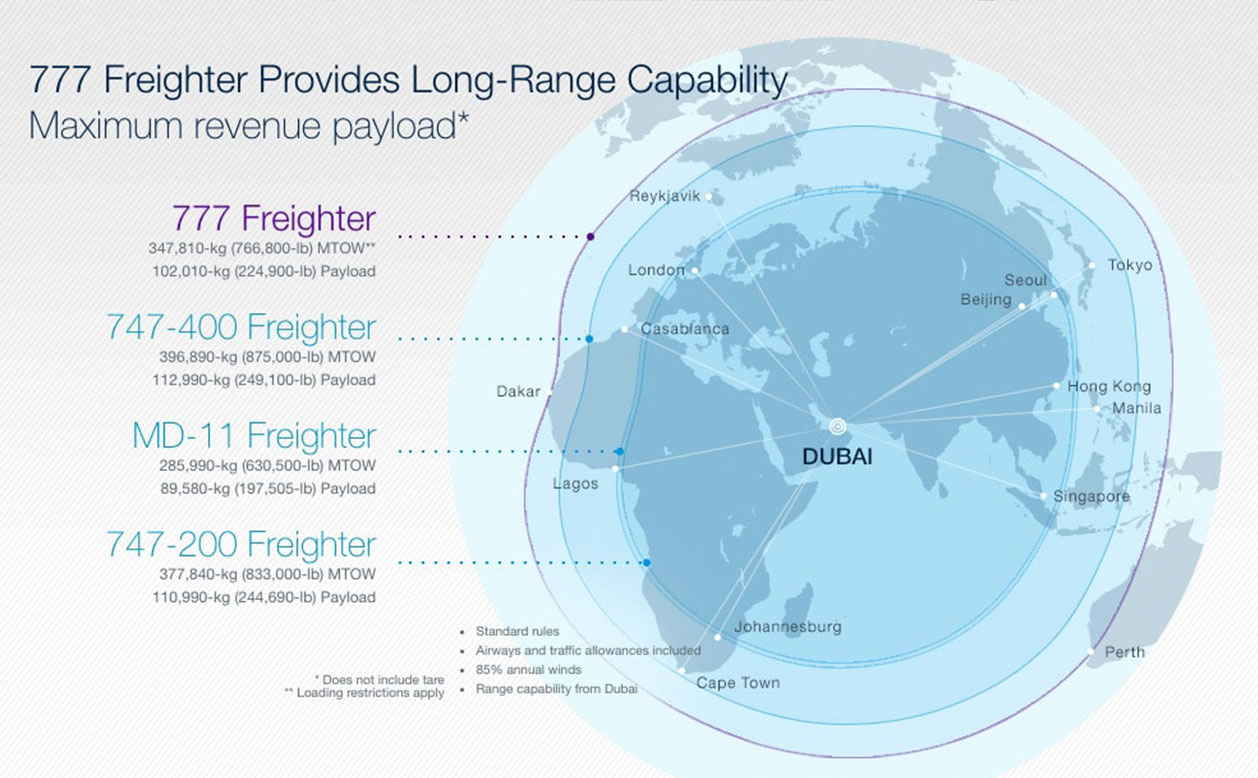

The B777-F has taken its place and is dominating current freighter fleets. It had its launch back in 2008, is a twin-engine freighter (while the B747 had 4 engines) and performs better in terms of range or operating costs. Especially during the rise of eCommerce in the 2010s, the B777-F could convince with high ranges while maintaining low operating costs. But oversize cargo can be a challenge due to a rather small main deck cargo door (compared to B747 or upcoming next era models).

Why a new era?

Airlines are asset heavy and subsequently try to optimize their fleet constantly. A task that requires great strategic planning as many factors need to be considered: Customer requirements per target market, payload, main-deck volume and pallets, max range, fuel burn per ton, maintenance and many more. In a nutshell: Cleaner, quieter and more efficient.

As today’s freighters had been designed more than a decade ago, they can lack behind in terms of current-gen engines, materials and all that derives from that (payload, max range or maintenance costs).

Versus the old B747-F, new era models can offer nearly the same payload (111-112 to) while reducing fuel burn per ton by almost 30% (as per Boeing’s 777-8F product flyer), making the new models not only more cost-effective, but also cleaner in terms of CO2 emissions. B747’s unique nose-door for oversize cargo remains unmatched. But most airlines prioritize operating costs per ton over nose-door use-cases as these are treated as niche business compared to the average shipment structure of cargo freighters.

Versus B777-F, the new era models, offer an increased payload while still reducing the operating costs per ton. Especially the A350F with the largest main deck cargo door of the industry (as per official product flyer) allows great flexibility when loading larger cargo.

A350F

Airbus’ A350F is based on the world’s most modern long-range aircraft A350. Both models share a commonality of up to 99%, allowing huge maintenance optimization when having both models in a fleet (i.e. maintenance operations or inventory costs for spare parts and tools). As per the official fact sheet, A350F is the first large freighter designed to meet ICAO’s latest CO2 emission standard. So far it has the largest main deck cargo door of the industry to facilitate loading of large dimensions, also allowing simultaneous loading on both decks. A350F leans into a network philosophy of high-volume cargo on long-haul routes. Entry in service is scheduled for 2027.

B777-8F

Boeing tries to capture the most important features of B747, B777 and other models in this all-new B777-8F freighter design. It is based on the B777X model and emphasizes max payload and low operating costs per ton, what may make it appealing for eCommerce where typically weight is the limiter rather than volume. Compared to the B747-F, it achieves similar payloads while having about 30% less fuel burned per ton. A huge improvement.

Who is Buying?

In the end, we most likely will find both models in most airlines’ fleets. On the one hand, airlines do not want to solely commit to one manufacturer. On the other hand, because both models have their unique value proposition and the combination of both may lead to maximum route optimization. Balancing payload monsters on dense eCommerce routes (B777-8F) with high performance on long-hauls with high-volume cargo (A350F).

Looking at the so far announced firm orders (see table below), only cargo carrier Silk Way West is opting to add both models to their fleet. But the life cycle for new era freighters is at the very beginning and it is too early to identify clear market trends. First new era freighters are not to be delivered before 2027 or 2028. And Boeing still has 63 unfulfilled orders for their current-gen B777-F, which will be delivered over the course of the next years; their retirement subsequently is still far away at the horizon.

As per July 2025, Boeing announces a total of 59 firm orders for it’s new B777-8F from six customers:

- Qatar Airways: 34

- Cargolux: 10

- Lufthansa Cargo 7

- China Airlines: 4

- ANA Cargo: 2

- Silk Way West: 2

Ethiopian Airlines signed a Memorandum of Understanding to purchase 5 aircraft

First deliveries are expected for 2028.

As per April 2025, Airbus logs 60 firm orders for their A350F by a total of 10 customers:

- Starlux Airlines: 10

- CMA CGM: 8

- Air Lease Corporation: 7

- Etihad Airways: 7

- Singapore Airlines: 7

- Cathay Pacific: 6

- Turkish Airlines: 5

- Air France: 4

- Martinair: 4

- Silk Way West: 2

First deliveries are expected for 2027.